Over the past three years, the Springboks have won the Rugby Championship, the World Cup and the much vaunted series against the British & Irish Lions. The withdrawal of South African teams from participating in Super Rugby was followed by further success as two local teams went all the way to the final in the United Rugby Championship (URC). So, by a measure of victories in cup competitions, South African rugby has performed relatively well.

But what do the fan attendance and revenue numbers say about the last three years?

On the 2nd November 2019, the Springboks beat England to lift the William Webb Ellis Trophy. Fast forward to March of 2020, South Africa and indeed many other countries entered the unprecedented period of nationwide lockdowns meant to manage and contain the effects of Covid-19.

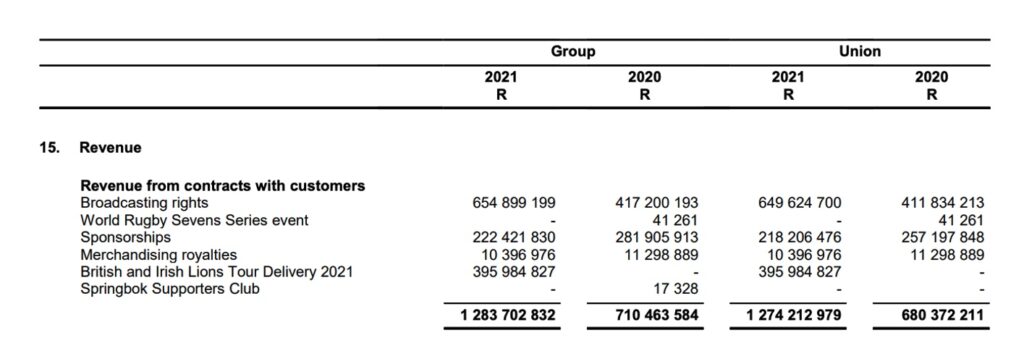

Along with the extensive restrictions came deep financial losses which affected all sporting codes. As a consequence, South African Rugby group revenues declined from R1.29 to R710 million in 2020 compared to the previous year. This was during a period in which South Africa and Japan were the only tier one nations not to play a match.

In responding to the effects of the pandemic, SARU conceived and implemented a Covid Industry Mitigation Plan

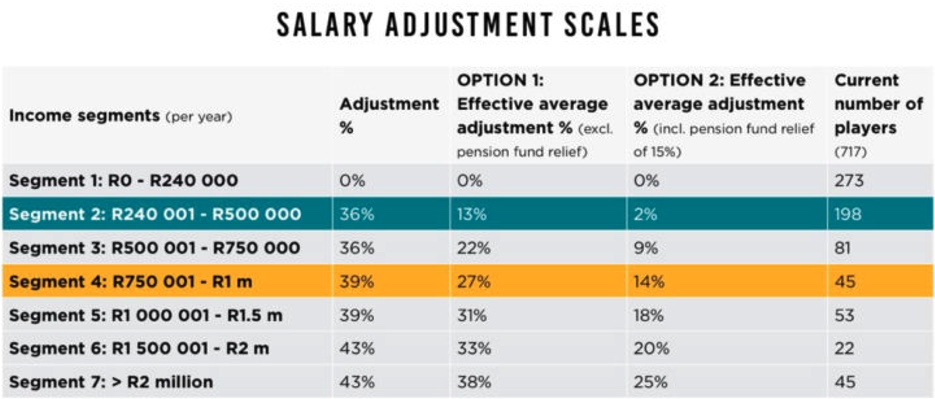

The SA Rugby COVID Industry Mitigation Plan focused on a worst-case scenario of cost cutting and savings of up to R1.2 billion from rugby’s global budget by reducing expenditure, and reductions in other operational budgets by 37.3% and 13% reduction in salaries.

The widely accepted plan necessitated most employees sacrificing a portion of their salaries which led to cuts amounting to 25% of total remuneration across the industry including administrators and players’ agents

Other arrangements that included negotiations with SANZAAR and broadcasting partners, were made. This enabled SA Rugby to continue participating in revenue share schemes even though the Springboks did not play test matches during the period. Compounding the squeeze of SARU finances was the fact that Super Rugby had ended prematurely.

The 2020 financial results put into perspective the devastating impact of Covid -19 on SARU’s activities. Broadcast revenue was R 411 million in 2020, down from R751 million the previous year while sponsorship revenue dipped from R334 million in 2019 to R257m in 2020.

The 2021 Recovery

As governments around the world lifted restrictions on team sports, SA Rugby entered into a joint venture structure with the British and Irish Lions Company to deliver the first joint venture event. The Unions’ shareholding of the venture was 50% and the accumulated profits as at 31 December 2020 stood at R2.55 million.

It was projected that the British and Irish Lions tour would create 13 300 temporary jobs with many evolving to sustainable and permanent jobs. SA Rugby expected 37 000 tourists to support the Lions across South Africa and that tax benefit to government was estimated to reach R450 million. Due to fans not being allowed in stadiums, the commercial success of the British & Irish Lions tour to South Africa did not live up to expectations but still contributed R395 million to SA Rugby revenue.

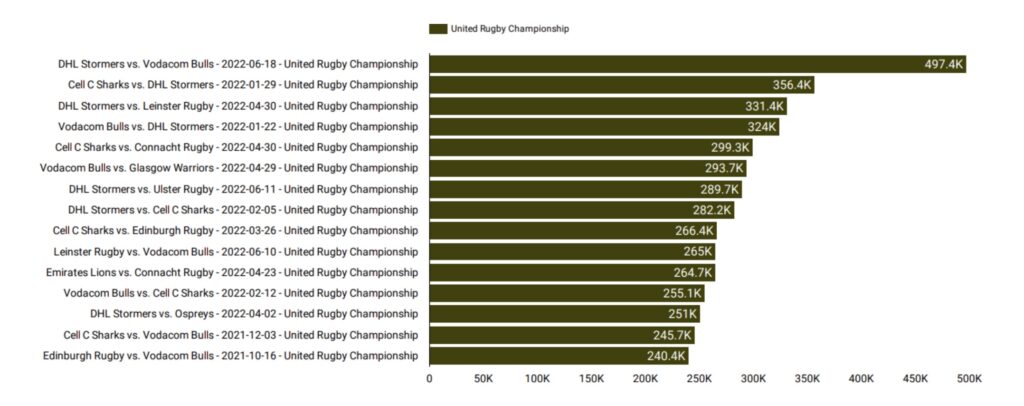

While SA rugby will not immediately share in the financial rewards of participating in United Rugby Championship (URC), viewership numbers over the 2021/22 season suggest that SA Rugby made the right call when it was decided to embark on the European journey. Overall, 26 out of the 150 games played reached 200 000 or more viewers and 36 reached more than 100 000 viewers. According to Nielsen Sports, the competition also continued to attract new viewers until the last week of the event with the final between the Stormers and Bulls attracting just shy of half a million viewers.

Private Equity Investment

Global rugby is undergoing a transformation at every level of the game due to the attractiveness of the game. The Six Nations received a major financial boost by way of CVC Capital Partners acquiring a stake in the region of R8 billion or £ 365 million.

Last month, a special general meeting of New Zealand Rugby in Auckland voted in favour of a $US 129.42 million private equity investment from U.S. firm Silver Lake. The deal, approved in a vote by a majority of the country’s provincial unions, values New Zealand Rugby’s commercial assets at NZ$3.5 billion. Should the deal be consummated, Silver Lake will take 5.71%-8.58% of a new entity to be called NZR Commercial Co.

In the pipeline is a potential deal between South African Rugby and CVC Capital Partners as articulated by president, Mr. Mark Alexander recently. While there is skepticism in some rugby circles and fears about the intense commercialization of the game, private equity participation in the commercial side of rugby can only improve the financial health of the sport to the benefit of players and the fans.

In summing up SARU’s rationale and interest in embracing private equity capital, the local governing body cites five imperatives which would require significant capital to implement. As articulated in the 2020 SARU Annual Report, these are.

1. Raising a significant amount of external capital to invest in our objectives over the long term

2. Placing SARU in a stronger financial position in the immediate and long term

3. Utilising capital to build and accelerate larger revenue streams for the immediate and longer term, such as digital

4. Providing the capability and financial support that creates leverage in all SA Rugby commercial negotiations with broadcasters, sponsors, and licencing partners

5. Fast tracking the association of our products with the best brands in the world.

With this new capital and partnerships, SA Rugby aims to position itself to “commercialise future growth, which will deliver the best international capability in sports media and entertainment while being strategically, commercially, and culturally aligned with SARU. Further key features include the ability for SARU to attract and incentivise strong talent, the capacity to provide significant access to capital, and the maximising of commercial rights with the largest rugby properties in the world”

As South African rugby forges ahead on a new and exciting growth trajectory, the on-field success of the four franchise teams in the URC as well as the Under 20 Six Nations Summer Series bodes well for the future for SA rugby.

Related Posts

February 20, 2024

World Sports Betting To Sponsor Western Province Cricket Association

World Sports Betting has announced a renewed sponsorship agreement with the…

February 20, 2024

MultiChoice Renews Rights To LALIGA, EPL And Champions League

SuperSport, the leading African sports broadcaster, has made significant…

February 20, 2024

New World TV Secures UEFA Competition Rights For Frech-Speaking Sub-Saharan Africa

New World have secured exclusive rights to broadcast the UEFA Champions League,…