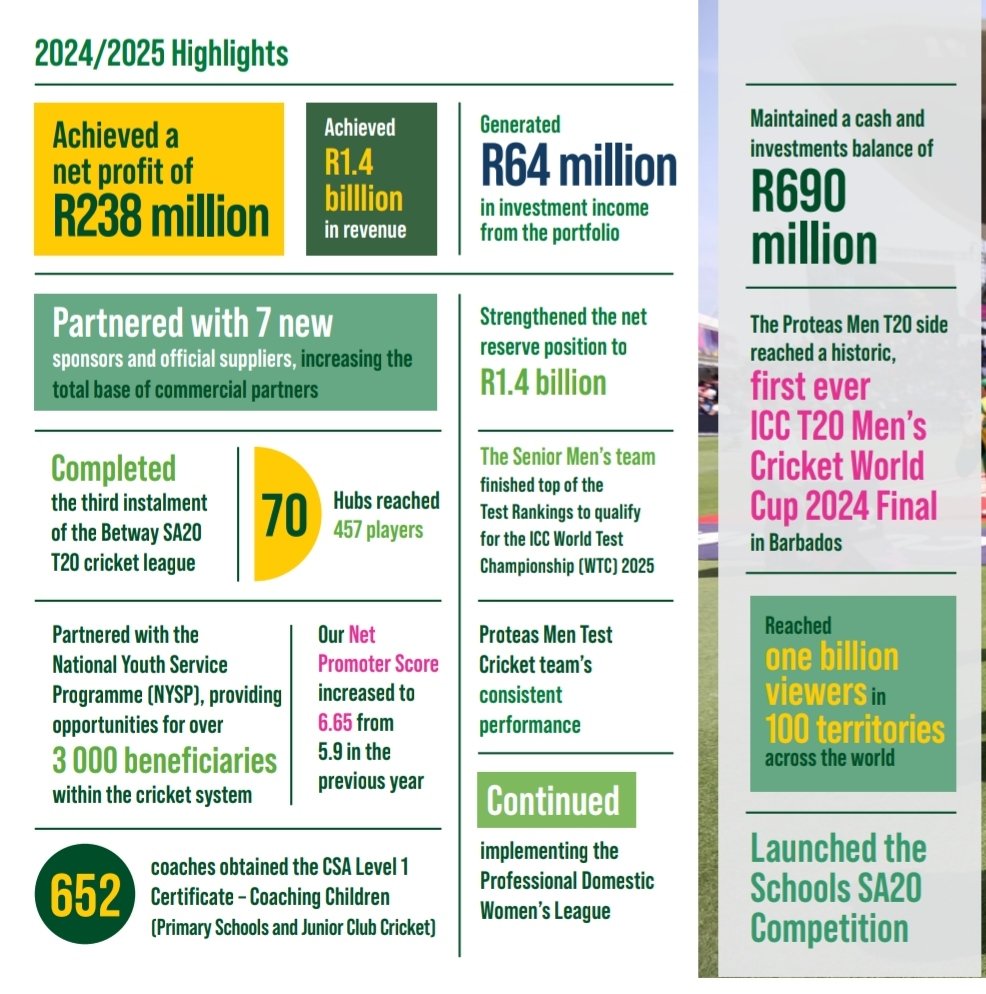

Cricket South Africa (CSA) released its 2024/25 Integrated Report today, marking the third consecutive year of profitability and further solidifying its financial recovery from years of turbulence. The organisation reported a net surplus of R238 million for the financial year, matching the figure posted in the previous year, and representing a major achievement given the increasing volatility in international cricket tour revenues.

The last three years have seen a steady climb in both earnings and stability for CSA. In 2022/23, CSA posted a profit of approximately R82 million off revenues just shy of R900 million. This set the stage for a breakout performance in 2023/24, as CSA surged past the billion-rand revenue mark for the first time in years, largely thanks to a lucrative home tour from India and growing commercial partnerships. That year closed with a surplus of R238 million, a figure that CSA has remarkably maintained through the 2024/25 cycle despite hosting fewer high-revenue tours.

The 2024/25 financial year brought in strong broadcast revenues of approximately R707 million, along with R378 million in ICC distributions and R125 million in sponsorship income. CSA also reported that its matches were watched in over 100 countries, contributing to a global audience exceeding one billion viewers. These numbers underscore the growing international appeal of South African cricket and the increasing value of its media rights portfolio. New sponsor partnerships have added further commercial momentum, with seven new agreements secured during the year.

Reserves have more than doubled since 2023/24, growing from just over R500 million to around R1.42 billion today. This significant increase in retained earnings provides CSA with an important buffer to navigate potential shocks and invest confidently in long-term growth. The expanded cash position also reflects greater discipline in managing operating expenses, even as costs have risen due to tour hosting obligations, player remuneration, and grassroots development initiatives.

However, CSA’s report also acknowledges some growing risks. Hosting incoming tours is becoming more expensive, and not all visiting nations guarantee financial returns. The cost of hosting less commercially attractive teams can place strain on CSA’s margins, especially in a competitive global calendar where player workloads and bilateral series often face disruption. This is compounded by rising capital expenditure associated with preparations for the 2027 ICC Men’s Cricket World Cup, which South Africa will co-host. Infrastructure upgrades, stadium refurbishments, and operational enhancements linked to the event will demand careful financial planning to avoid cost overruns.

Looking ahead to the 2025/26 financial year, CSA has reason for optimism. Several incoming tours are on the calendar, promising additional gate, broadcast, and sponsorship revenue. The upcoming year also positions CSA to begin monetising the World Cup build-up more aggressively through event-linked sponsorships, fan engagement initiatives, and media packaging. With the global spotlight slowly turning toward the 2027 World Cup, South African cricket has a unique opportunity to elevate its brand visibility and commercial value.

Looking ahead to the 2025/26 financial year, CSA has reason for optimism. Several incoming tours are on the calendar, promising additional gate, broadcast, and sponsorship revenue. The upcoming year also positions CSA to begin monetising the World Cup build-up more aggressively through event-linked sponsorships, fan engagement initiatives, and media packaging. With the global spotlight slowly turning toward the 2027 World Cup, South African cricket has a unique opportunity to elevate its brand visibility and commercial value.

The momentum in broadcast viewership is another tailwind. With international interest in Proteas matches growing, CSA is well placed to renegotiate broadcast deals, explore streaming partnerships, and diversify its revenue mix. Digital transformation and stronger data capabilities may open up new income streams while deepening fan engagement. At the same time, continued ICC support and a stable sponsorship base will help cushion against potential downturns.

Nonetheless, CSA must remain vigilant. Economic volatility, currency depreciation, and inflationary pressures in the local and global economy could affect operational costs and sponsorship appetite. The risk of postponed or cancelled tours, a feature of the post-pandemic cricketing environment, also remains a wildcard that could dent earnings. Ensuring that key tour windows are protected and that player welfare is balanced with commercial needs will be vital.

In summary, CSA’s 2024/25 report confirms the organisation’s continued financial turnaround and positions it well for a year of strategic importance. The ability to maintain profitability across two consecutive years, while growing reserves and expanding commercial influence, reflects sound governance and improved operational discipline. As the organisation gears up for one of the most important cycles in its modern history—with incoming tours and a World Cup looming—CSA’s leadership will need to build on this momentum with prudence, creativity, and a long-term view.

Related Posts

July 23, 2025

Canal+ Acquisition Of MultiChoice Approved

South Africa’s Competition Tribunal has granted conditional approval to French…

June 12, 2024

MultiChoice Financials Reflect Difficult Year

MultiChoice Group Limited (MCG) has released its financial results for the year…

June 11, 2024

Uganda Enters Into Agreement With Turkish Company On Hoima Stadium Build

The Government of Uganda has entered into a contract with the Turkish company…