When Formula 1 boss Stefano Domenicali remarked that Las Vegas and Africa could both hold races in the future with the calendar set to grow, there was plenty of excitement at the prospect of an African GP. This was further amplified by Lewis Hamilton stating that he too would like the race to come to Africa and South Africa specifically. But what are the chances of the rainbow nation hosting an F1?

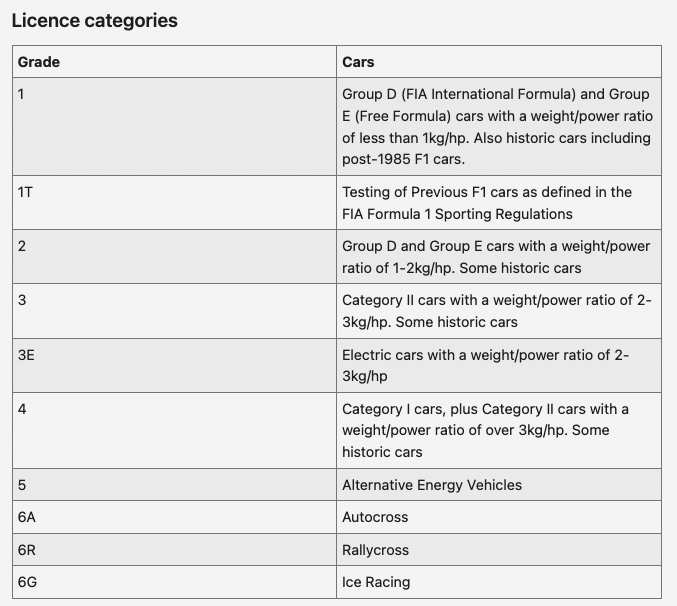

To begin with, there must be a Grade 1 venue to host the race. This can come in the form of a permanent track like the one we have at Kyalami or a street circuit. In order to host a Grand Prix, tracks have to conform to FIA guidelines that run into hundreds of pages, with regulations covering everything from track dimensions to the type of medicinal supplies stocked in the on-site medical centre. Mandatory inspections must take place in order to ratify a track’s licence, and the higher the grade required, the higher the fee the circuit must pay

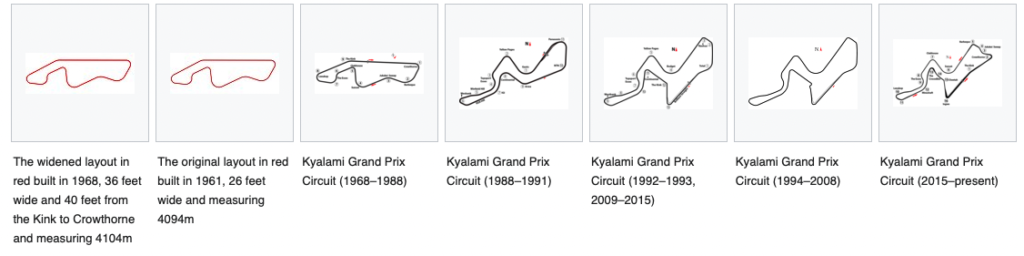

Kyalami was built in 1961 and hosted 21 editions of the South African Formula 1 Grand Prix through to 1993 when the costs of another rebuild, necessitated by stricter track requirements, became too high to manage and the track lost its F1 status. Being a category 2 track, Kyalami continued hosting other race events but the ambition to get it back to tier one status only began taking shape when Toby Venter bought the venue in 2014 for a fee reported to be in the region of R205 million.

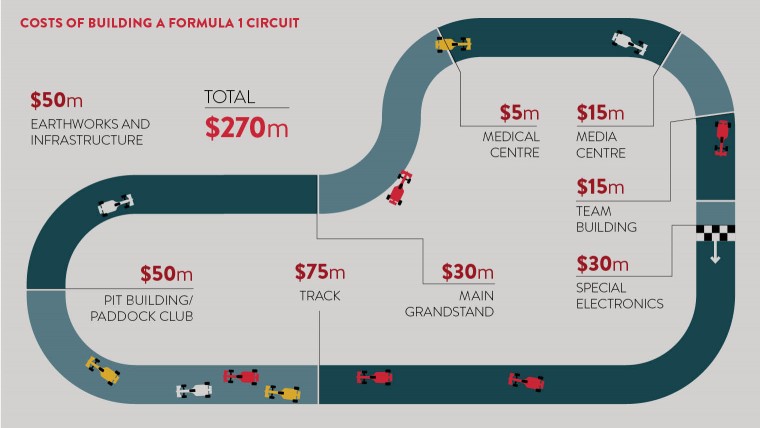

Since taking over, Venter and his partners have invested over R100 million to make the venue suitable for F1 races and according to him, there is a real possibility that 2023 could see South Africa back on the circuit map. While the financial outlay may seem excessive, the cost is far less than building a venue from scratch and even less than the cost for a street circuit.

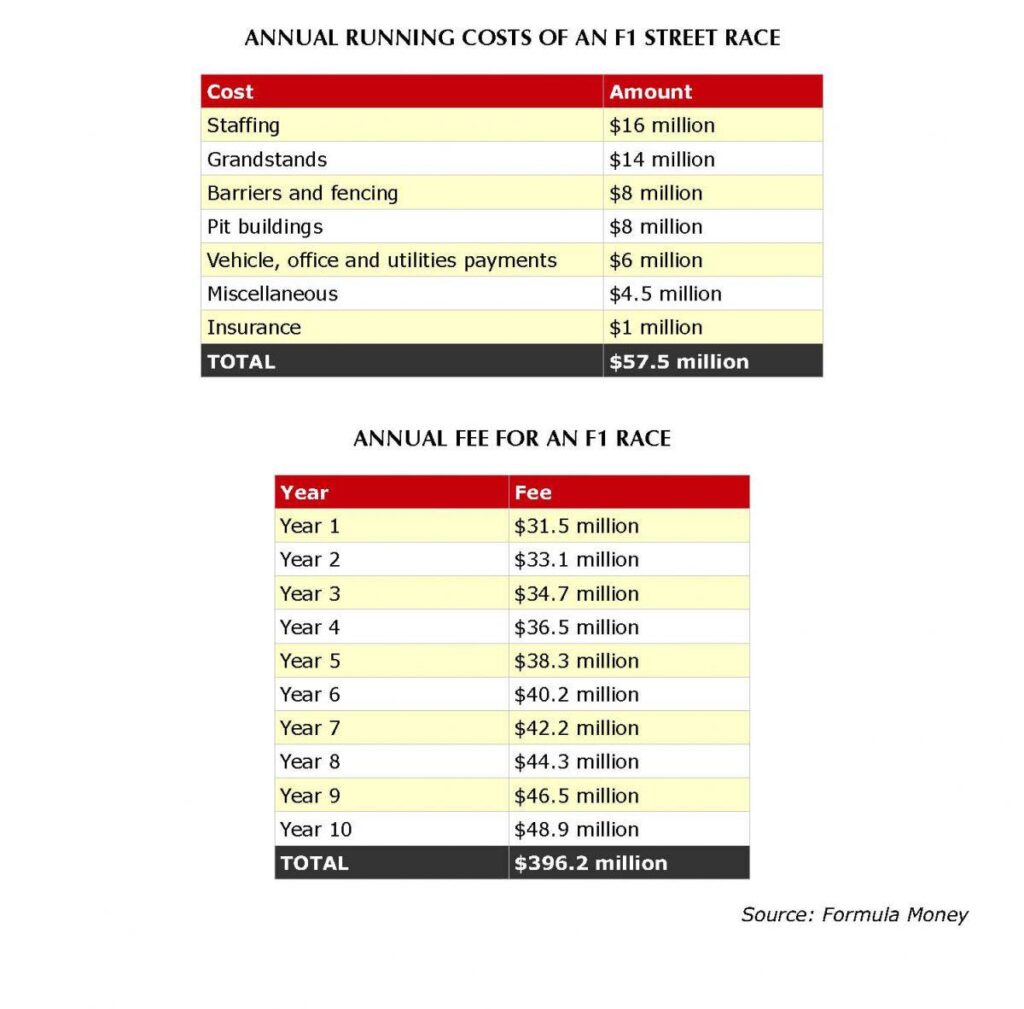

A street circuit could cost up to $57 million or R830 million to operate on an annual basis with costs such as $30 million for staffing and grandstands, $16 million for barriers, fencing and pit buildings as well as $1 million for insurance. In truth, the venue is hardly a problem as it can be used for multiple other activities and can generate income throughout the year. What is much more of a problem is the hosting fees that have to be paid to Formula 1 in order to secure a place on the race calendar.

The cost of hosting a Formula One race depends on the duration of the contract signed. Most new venues will sign contracts up to ten years with the fee increasing to a maximum of $48 million in the final year. There are some older and more venues that pay less but the average fee paid per venue is $44 million or R641 million.

With fees reaching up to a billion dollars over a ten year period, it’s inevitable that government support will be needed to finance the event. An event that points to a Grand Prix being hosted here is the Kyalami 9 Hour which was endorsed and supported by the Gauteng local government. The economic impact of the event was huge with a rumoured 17000 employees, up to 200,000 spectators across the race weekend, 500 international media, 30 teams and their support staff. It’s unknown how much financial support was provided by local government but it is said that the economic benefit to the immediate area in rooms booked, spending on entertainment and shopping as well as tourism was over R100 million.

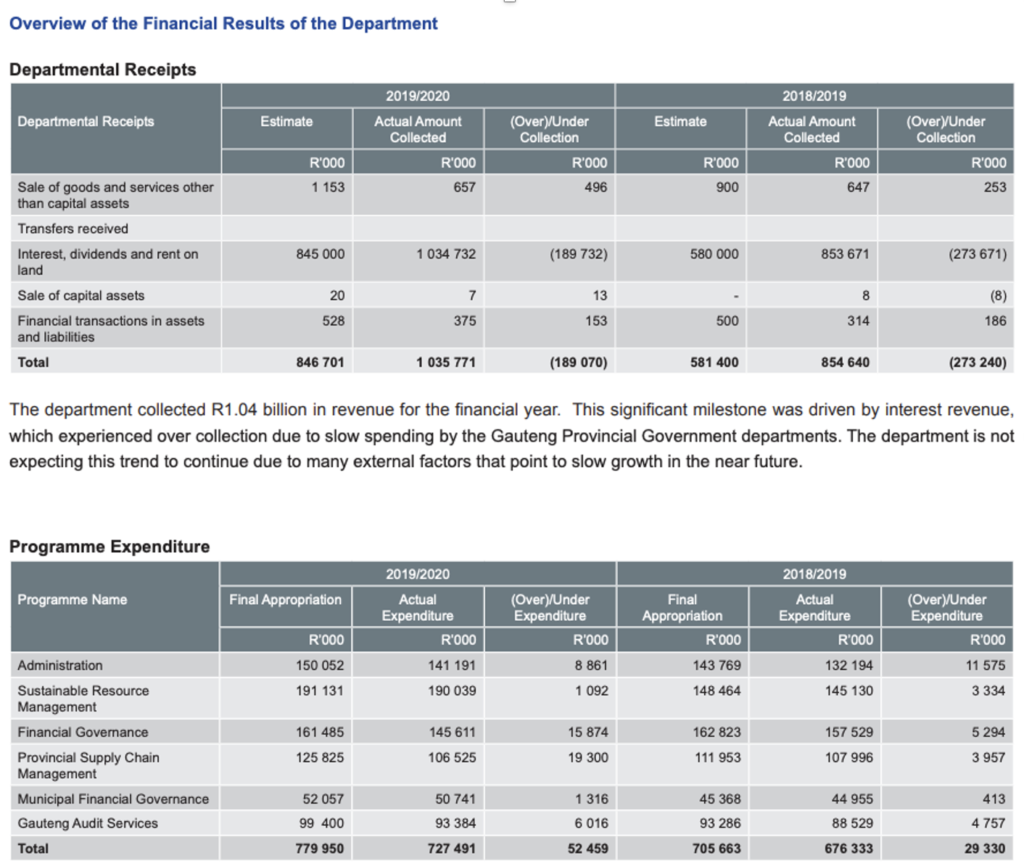

In January, it was announced that the Singapore GP would be renewed for another seven years because of the massive economic benefit that city has seen as a result of Formula 1. Host organizers Singapore GP Pte. Ltd. and the Singapore Tourism Board reportedly paid $35 million per Grand Prix in the previous contract with the race helping the country to generate more than $1.1 billion in tourism receipts and attract more than 550 000 international visitors since 2008. A look at the Gauteng Provincial Governments financial accounts suggests that funding would have to come from other sources as there simply is not enough money in their coffers to justify the financial outlay. What the government can do is ensure that we have a policy position which is not restrictive and allows full capacity attendance unlike what we have seen over the last two years with no fans and then 50% of the capacity of an outdoor venue being filled

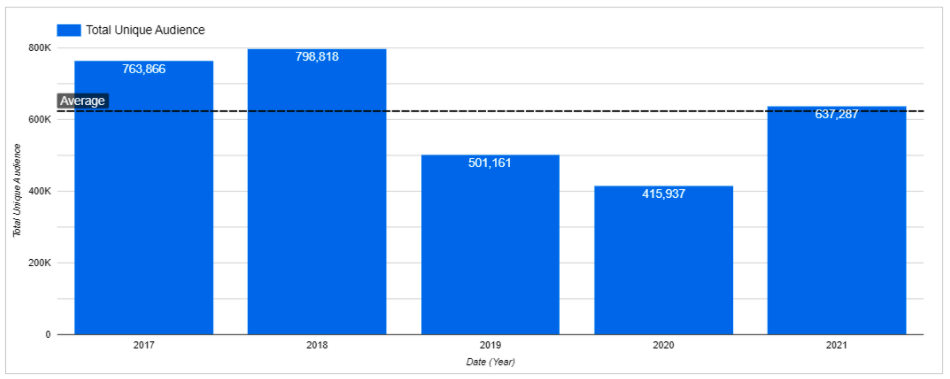

Beyond the financial and policy matters above, we have to ensure that enough people are watching the event, both on television and at the circuit itself to justify the sponsorship revenue needed to keep F1 interested in a South African event. To get an understanding of the state of Formula 1 in the eyes of South Africans, the best place to look is Nielsen data. Data of live coverage of Formula 1 races on SuperSport is strong and has largely remained around the 600 000 unique audience mark since 2017. With only 18 races in 2018, the number of total unique viewers reached 415 000

Interestingly the face of F1 viewership in 2021 changed and included a lot more female viewers. Nielsen estimates that there were 637,287 unique viewers of Formula 1 during the 2021 season with 40.6 of those being female and 26% of the total audience aged between 25 and 49.

A poll I put out on twitter to gauge support for F1 and where it came from showed that a large number of people had either been fans long before the arrival of Drive To Survive and their passion was reignited by the show or started watching directly as a result of the show on Netflix.

While the drivers themselves may not like the Kardashian like drama created by producers of the show, the resultant increase in new fans cannot be ignored. The last six races of the season averaged 200,00 unique viewers with the action packed Abu Dhabi GP racking up 302,000 unique viewers.

While the drivers themselves may not like the Kardashian like drama created by producers of the show, the resultant increase in new fans cannot be ignored. The last six races of the season averaged 200,00 unique viewers with the action packed Abu Dhabi GP racking up 302,000 unique viewers.

We have the circuit, the beautiful city and fans to pull off an incredible Grand Prix. Whether we can manage the finances required remains to be seen.

Related Posts

November 12, 2025

MI Cape Town and DHL Renew SA20 Deal

MI Cape Town has renewed its sponsorship agreement with DHL

September 20, 2025

Cricket South Africa Posts R238 million Surplus

Cricket South Africa (CSA) released its 2024/25 Integrated Report today,…

July 23, 2025

Canal+ Acquisition Of MultiChoice Approved

South Africa’s Competition Tribunal has granted conditional approval to French…